Facing a tax bill you can’t pay can be stressful, but it’s important to understand that ignoring the problem will only make matters worse. If you find yourself unable to pay your tax bill on time, here’s what you need to know.

Contact HMRC immediately

The most important step is to contact HMRC as soon as you realise you’ll have difficulty paying, or won’t meet their payment deadline for any other reason. Don’t wait until after the deadline has passed. If you do not get in contact, HMRC will not only charge you interest and penalties, but also has wide ranging powers to enforce the debt, which can include using debt collection agencies, taking money from your wages or bank account, etc.

Set up a Time to Pay arrangement

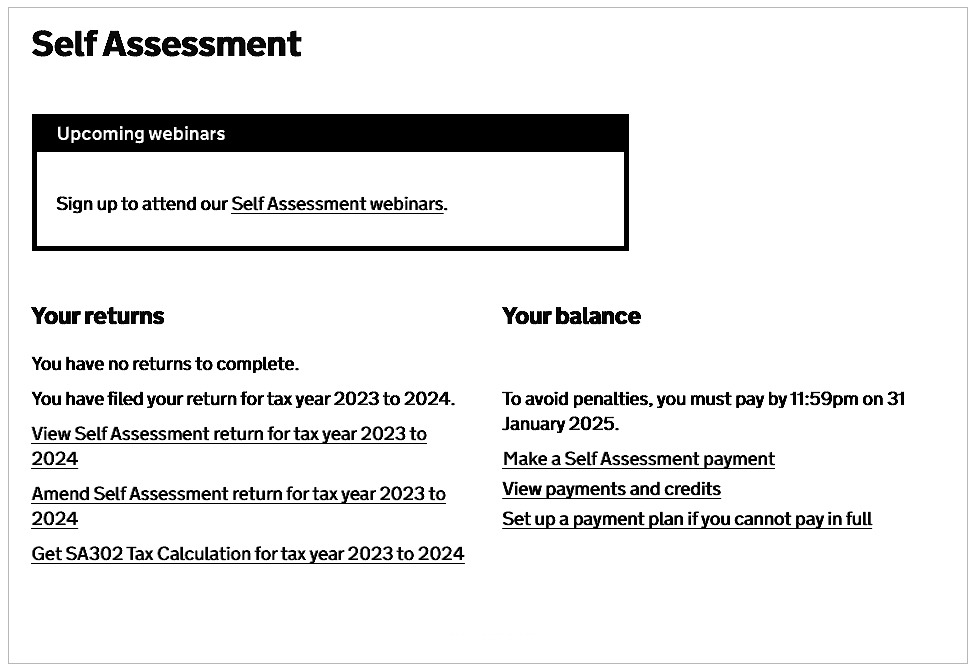

If you can’t pay your tax bill by the deadline (usually 31 January for Self-Assessment), HMRC offers Time to Pay arrangements, which allow you to spread your tax bill over multiple monthly instalments. You will need to have filed your tax return before setting up a Time to Pay arrangement. If you owe £30,000 or less, and you do not have any other payment plans or debts with HMRC, the simplest way to set up a payment plan is online through your Government Gateway account. When setting up a payment plan online, you will be asked how much you are currently earning and how much your essential outgoings are. You will be presented with options on the instalment amount based on your disposable income and the repayment period you choose. You can choose to set a higher amount if you think you can afford to, but if you need to reduce the amount, you will have to call HMRC to arrange a plan. A payment plan online can only be done within 60 days of the payment deadline, but we suggest you do this within 30 days of the payment deadline to avoid penalties being charged.

For larger amounts, or where you can’t set up a Time to Pay arrangement online, you’ll need to speak with HMRC directly on 0300 2003820.

When you request a Time to Pay arrangement by phone, be prepared to:

- Explain why you can’t pay in full

- Suggest how much you can pay immediately

- Propose how long you’ll need to pay the remaining balance

- Share details about your income and expenditure

- Demonstrate that you can realistically afford the proposed payments

Understanding the interest charges for late payment of self assessment tax

While HMRC may allow you to pay in instalments, they will charge interest on late payments. Understanding these charges is crucial for budgeting your repayment plan. Interest starts accruing from the day after the payment was due. The interest rate is currently 7.25% per annum (as of January 2025), and will increase by a further 1.5% from April 2025 onwards. This rate can change, so it’s worth checking HMRC’s website for the most current figure.

Understanding the penalty charges for late payment of self assessment tax

It’s worth noting that penalties for late payment are in addition to any charges for filing your tax return late. Penalties for late payment are charged in stages:

- 5% penalty is charged on tax that is unpaid after 30 days

- Another 5% penalty is charged on tax that is unpaid after 6 months

- Another 5% penalty is charged on tax that is unpaid after 12 months

However, HMRC won’t charge late payment penalties provided you have agreed a Time to Pay arrangement with them within 30 days of 31 January 2025.

Keep your records updated

Maintain detailed records of all communications with HMRC as this documentation could prove valuable if there are any disputes later. Keep records of:

- Dates and times of phone calls

- Names of HMRC officers you speak with and the phone number you contacted them on

- Reference numbers for any agreements made

- Copies of all correspondence

Avoid Common Mistakes

Don’t ignore reminders or letters from HMRC. This can lead to enforcement action, which might include:

- Taking money directly from your bank account

- Using debt collection agencies

- Taking control of your goods

- Court action

- Bankruptcy proceedings

Additionally, don’t file your tax return late just because you can’t pay. The penalties for late filing are separate from and additional to late payment penalties.

Plan for Future Tax Bills

Once you’ve arranged to handle your current tax bill, take steps to avoid similar issues in the future:

- Set aside money regularly for tax payments

- Consider opening a separate savings account specifically for tax

- Keep records up to date throughout the year so you can estimate your tax bill as you go along

- Review your tax code to ensure it’s correct

- Consider paying tax bills by instalments – you can set up a Budget Payment Plan with HMRC

Getting Professional Help

HMRC’s primary goal is to collect tax, not to punish taxpayers who are genuinely struggling. They would rather work with you to arrange manageable payments than force you into financial hardship. However, they can only help if you communicate with them openly and honestly about your situation. Above all if you’re having difficulty paying your tax bill, don’t panic and take action early. With proper planning and communication, you can get back on track with your tax obligations.

If you’re struggling to manage your tax affairs, consider seeking professional help from Gardner Webb Accounting. Whether you’re self-employed, a director of your own limited company, a business investor, a property landlord, or a combination of these things, our team of experienced personal tax accountants are here to simplify the process and help you meet your tax obligations efficiently. Get in touch to find out more about our services.