The Coronavirus Job Retention Scheme (furlough) has been extended until 30 September 2021. The furlough scheme is changing from 1st July 2021.

So, what’s changing?

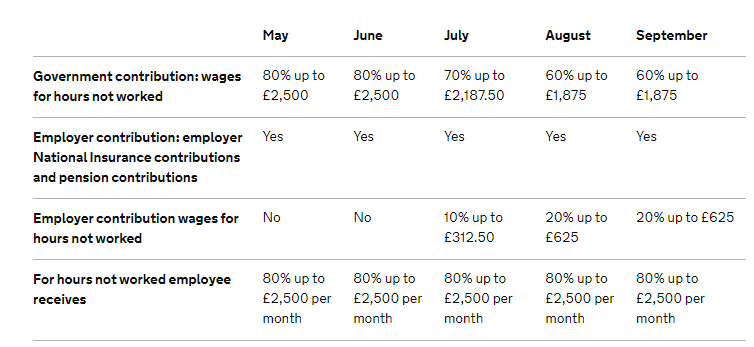

Previously, employers have been able to pay furloughed staff 80% of their usual wages (up to £2,500 per month) and claim this money back through the government whilst covering the employer national insurance and pension contributions themselves.

From 1 July 2021, the level of this grant will be reduced and you will be asked to contribute more towards the cost of your furloughed employees’ wages.

Okay, how much more do I have to pay?

From 1 July 2021, the government’s contribution to furlough payments will be reduced to 70% of an employee’s wages (up to £2,187.50). Businesses will be asked to contribute the remaining 10% of the 80% furlough wage (up to £312.50 per employee).

Businesses will need to continue making their employer National Insurance contributions and pension contributions.

How long will the Coronavirus Job Retention Scheme last?

The furlough scheme at present will be run up to the end of September 2021. Boris Johnson and Chancellor Rishi Sunak both said recently that they do not want to extend furlough again.

The hope is that the country will have reopened by September, with most employees able to return to full time work.

If the scheme is not extended again employers will have to decide whether to take furloughed workers back again or make them redundant if they cannot afford to pay them.

If you have employees who you think might be at risk of redundancy, please take advice at the earliest opportunity. There are special rules potentially preventing you from claiming furlough entitlement for employees who are serving notice periods.

Are there any other changes I need to know about?

In short, yes. Whilst at no point should a furloughed employee receive less than 80% of their pre-furloughed wage, the next three months will see a winding down of the government support, with government contributions further decreasing and employers being asked to make up the shortfall.

In August 2021 and September 2021 the government will contribute to 60% of a furloughed employee’s wages (up to £1875), and employers are asked to contribute the other 20% (up to £625) of the wages.

This table from the HMRC website provides a helpful visual of government and employer contributions: